We have qualified customs brokers who are well-versed in customs procedures and related laws, leveraging their extensive knowledge and experience. Smooth customs processing requires abundant experience, know-how, and advanced specialized knowledge. Not only is accurate declaration in compliance with the Customs Business Act, Customs Tariff Act, and Customs Tariff Rate Act essential, but precise handling of various laws such as the Pharmaceutical Affairs Law, Food Sanitation Law, and Import and Export Trade Management Order is also indispensable.

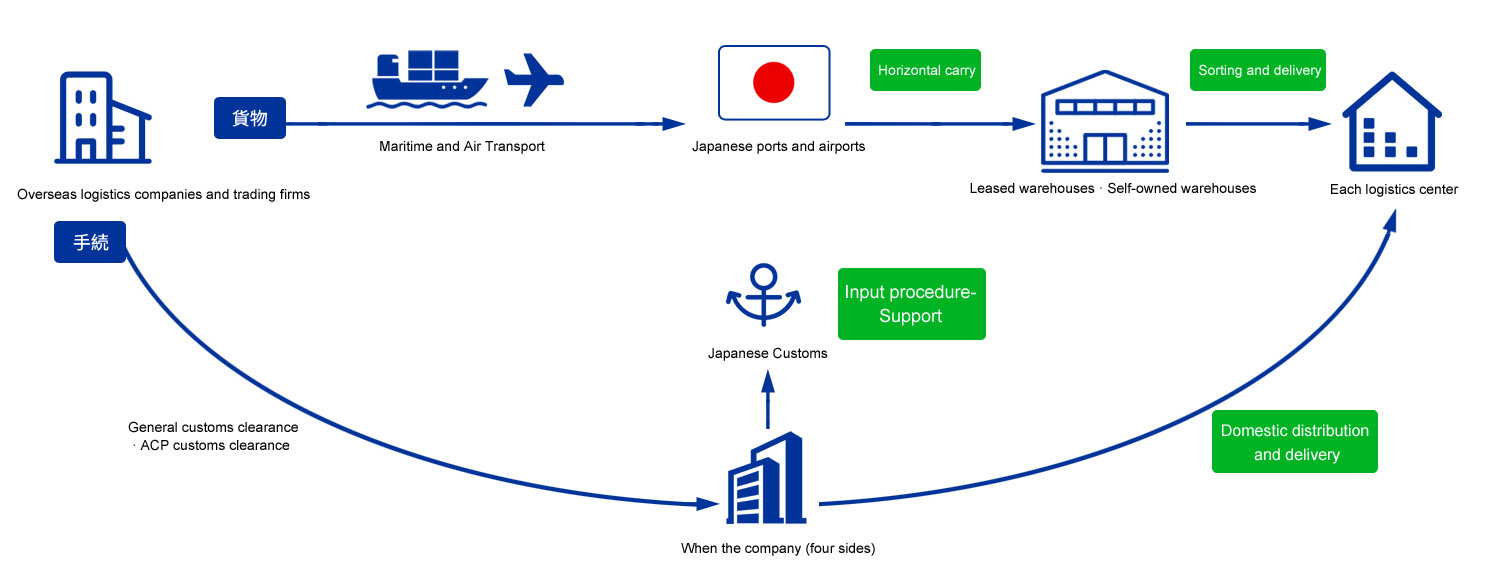

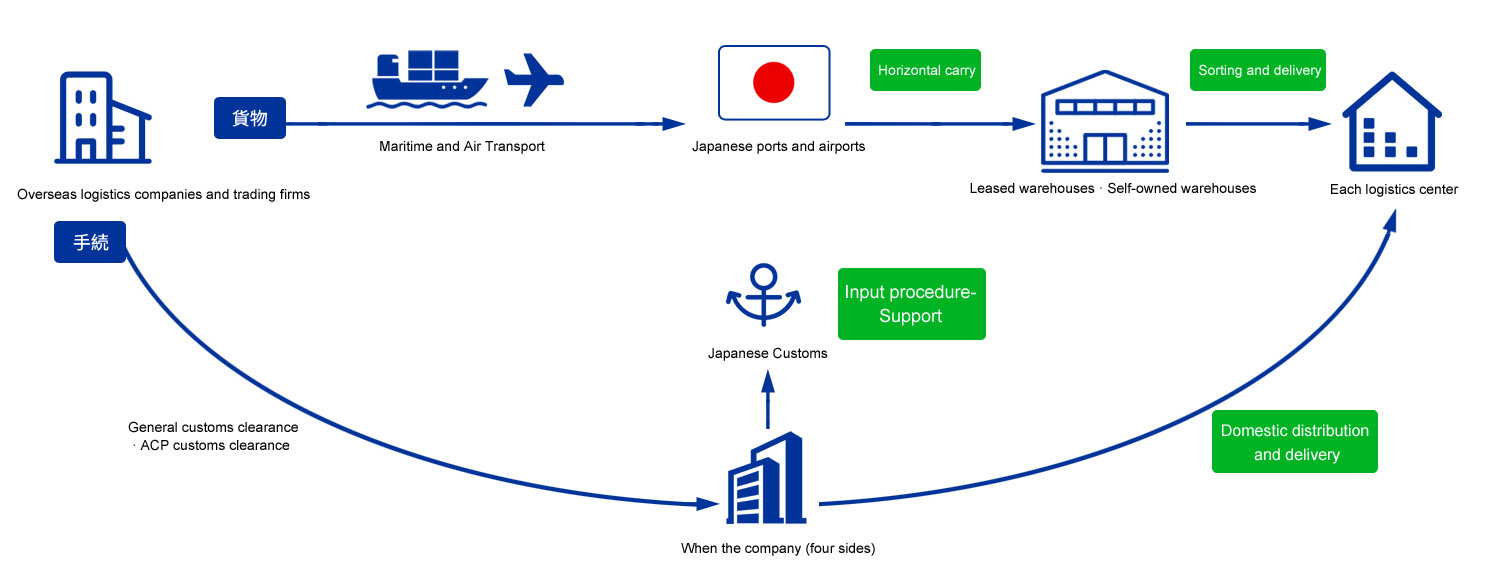

The process of import and export customs clearance operations

・Input customs declaration

When goods arrive in Japan from abroad (by ship, plane, etc.), they are treated as foreign goods and temporarily stored in bonded areas at ports or airports. To handle these foreign goods as domestic circulation goods in Japan, an import declaration must be filed with the customs authority overseeing the bonded area where the goods are stored. The import declaration involves verifying the item name, quantity, price, etc., based on the goods' documents (invoice, packing list, B/L, etc.), conducting content inspection and sorting, and then creating a declaration form, after which the import declaration is completed (tax payment declaration method). If necessary, the goods may undergo inspection by customs.

・Output customs declaration

When shipping goods from Japan to a foreign country, it is necessary to first transport them to a bonded area, obtain entry confirmation in the bonded area for goods ready for export, and then declare the export to the customs authority overseeing the bonded area. Here, "export readiness" refers to finalizing the quantity, weight, and packaging of the goods, securing reservations for ships or aircraft, and preparing documents (such as invoices, packing lists, bills of lading, and other legally required certificates). "